Should Your Barbershop Go Cash-Free? A Practical Guide to Accepting Cards

Is it time for your barbershop to ditch the cash drawer? The short answer is yes, but you don't have to go completely cashless overnight. For most shops, the smartest first step is a hybrid cash-and-card model. This approach lets you meet modern client expectations without alienating loyal, cash-paying regulars. This guide provides actionable steps, real-world examples, and the specific numbers you need to make the right choice for your business.

The Modern Barbershop Dilemma: Cash vs. Card

Choosing your payment methods is a core business decision that shapes your brand, customer experience, and daily operations. For generations, barbershops have run on cash—it’s simple, direct, and has no transaction fees. But today, consumer habits have shifted dramatically, and relying solely on cash can turn away a significant portion of your potential clients.

According to a 2023 Square report, 87% of barbershop transactions are now cashless. Convenience is king, and customers factor payment options into their choice of where to get a haircut. This puts shop owners in a tough spot: stick with the familiar, fee-free cash model, or adapt to customer demand and unlock new growth?

The decision comes down to weighing the costs against the potential gains.

- Operational Efficiency: Card payments, powered by a good Point of Sale (POS) system, automate bookkeeping and eliminate time-consuming bank runs. The trade-off? You'll need a reliable internet connection and POS hardware.

- Customer Experience: Accepting cards is a baseline expectation for most clients today. It can lead to more frequent visits and attract new customers who don't carry cash.

- The Financial Impact: Digital payments come with processing fees, typically between 1.5% to 3.5%, that reduce your profit on every service.

Actionable Takeaway: Think of card fees not just as a cost, but as a marketing expense. If a 2.5% fee brings in a new $40 client who wouldn't have come otherwise, you've spent $1 to make $39. That's an ROI most marketing campaigns can't match.

To make an informed decision, let's compare the two models head-to-head.

Quick Look: Cash vs. Card Payments

Here’s a straightforward comparison to help you weigh the pros and cons for your own barbershop.

| Factor | Cash-Only | Accepting Cards |

|---|---|---|

| Transaction Fees | None. You keep 100% of the sale. | 1.5% - 3.5% per transaction. |

| Customer Base | Caters to traditional, local, or older clients. | Attracts a wider, often younger, demographic. |

| Bookkeeping | Manual, error-prone, and time-consuming. | Sales, tips, and taxes are tracked automatically. |

| Average Ticket Size | Limited by the cash a client has on them. | Higher potential for add-ons and retail sales. |

| Security Risk | High risk of theft, counterfeit bills, and miscounts. | Low physical risk; digital risk managed by PCI compliance. |

Deciding isn't just about avoiding fees; it’s about positioning your shop for the future and making it as easy as possible for customers to pay you.

Breaking Down the Financials of Going Cashless

When considering a move away from cash, the bottom line is paramount. It’s easy to fixate on transaction fees, but a smart business decision requires looking at the complete financial picture—including the hidden costs of a cash-only operation.

The most visible cost of accepting cards is the processing fee. For a small business, these fees can feel significant. Typically, you're looking at 1.5% to 3.5% for every swipe, tap, or digital payment. While it sounds small, those percentages add up.

Calculating the Real Cost of Card Fees

Let’s run the numbers for a typical barbershop generating $5,000 in revenue a week.

- With a 2.6% + 10¢ fee (a standard Square rate), you’ll pay $130 + transaction fees for that week.

- If your average transaction is $40, that's 125 transactions. The 10¢ fee adds another $12.50, bringing your weekly total to $142.50.

Annually, that's $7,410. You also need to factor in initial hardware costs. A basic card reader starts around $49, but a full POS station could be over $1,000. These are direct costs that impact your profit margin.

The Hidden Costs of a Cash-Only Model

Cash feels free because there are no direct processing fees, but it comes with its own "hidden" operational costs that chip away at your time and profit.

Actionable Takeaway: Track the time you spend on cash-related admin for one week. A 30-minute daily bank run and 15 minutes cashing out equals 3.75 hours a week. At an owner's value of $50/hour, that's nearly $190 in lost time—more than the card fees in our example.

Think about the time-consuming tasks a digital system automates:

- Daily Bank Runs: A 30-minute trip to the bank each day is 2.5 hours a week. That’s time you could spend cutting hair, marketing, or training staff.

- Manual Bookkeeping: Tallying sales, tracking tips, and balancing the drawer can easily consume 5-10 hours per month.

- Security Risks: A cash-filled drawer is a target for theft, counterfeit bills, and simple counting errors.

When you weigh the clear, predictable cost of card fees against the often-overlooked costs of managing cash, you get a much clearer picture of the true financial impact. Exploring strategies to optimize your ROI can help you see how an investment in modern payment systems often pays for itself, allowing you to make a decision that's truly best for your business.

How Card Payments Improve the Customer Experience

Beyond the financials, going cash-free is about creating a smoother, more modern experience for your clients. Today's consumers expect speed and simplicity, and the payment process is a critical part of their overall satisfaction with your shop.

Moving to card payments removes friction at checkout. The old cash routine—running to an ATM, fumbling for bills, waiting for change—is a hassle. A tap-to-pay transaction is completed in seconds. This speed gets clients out the door faster and helps you turn chairs more efficiently, potentially allowing for an extra cut each day.

Bumping Up Your Average Ticket

Accepting cards isn't just about speed—it’s a proven strategy to increase client spending. When people aren't limited by the cash in their pocket, they're far more likely to approve impulse buys or service upgrades.

This psychological shift can significantly boost your daily revenue. For instance, a client who came for a $40 haircut might easily add a $25 beard trim or grab a $20 bottle of pomade when they can just tap their card. With those two additions, you've increased revenue from that single appointment by 112%. This is an opportunity almost always lost when a customer only brought two twenty-dollar bills.

How to Tell Your Clients You're Making the Switch

For regulars accustomed to paying with cash, a smooth transition is key. Frame the change as a benefit for them, not just an operational shift for you.

Actionable Takeaway: Create a simple, professional sign for your front desk and mirrors. Use this script: "To serve you better with faster, more secure checkouts, we now prefer card and contactless payments. We still happily accept cash. Thank you!"

Here’s a practical plan for managing the transition:

- Give a Heads-Up: Announce the change at least a month in advance using signs and social media posts.

- Explain the "Why": Keep the message client-focused. Emphasize benefits like speed, convenience, and security.

- Start with a Hybrid Model: Accept both card and cash for at least 3-6 months. This gives regulars time to adjust and shows you value their loyalty.

This customer-first approach aligns with industry trends. Data shows that 70% of salon and barbershop clients already prefer cashless payments. By meeting this expectation, you’re not only keeping current clients happy but also positioning your shop for future growth. You can learn more about how cashless systems are benefiting modern shops over at dingg.app.

Streamlining Your Shop with Digital Operations

Moving away from a cash-only model does more than just change how customers pay—it fundamentally reshapes how you run your barbershop behind the scenes. When you bring in a modern Point of Sale (POS) system, you start automating the tedious admin work that eats into your day, letting you get back to focusing on your craft and your clients.

Instead of manually logging every service, a digital system tracks each sale in real-time. This eliminates guesswork and painful end-of-day cash counts. Your revenue reports—daily, weekly, monthly—are always accurate and available with a few clicks. This automation also simplifies team management. Calculating staff commissions, a common headache, becomes an automated process. The POS tracks each barber's services and sales, applies commission rules, and generates a perfect payroll report.

Reclaiming Your Time with Automation

Let's quantify this. A shop owner spending 30 minutes a day cashing up and two hours a week on bookkeeping is losing 4.5 hours every week. For a busy owner, that's 18 hours a month—over two full workdays—lost to tasks a POS system can do instantly.

Actionable Takeaway: Use the 15-20 hours you reclaim each month for revenue-generating activities. Spend that time engaging with clients on social media, running a promotion for a new service, or providing one-on-one training to a junior barber. This turns saved time into tangible profit.

This shift also slashes the risk of human error, ensuring your books are clean and your staff is paid correctly every time. If you’re curious about other ways to simplify your shop's daily grind, it’s worth understanding the core business process automation benefits to see what's truly possible.

Comparing Physical vs. Digital Security

Security is a major concern for shop owners. While digital payments introduce new considerations, they create a far more secure environment than a cash-heavy operation.

Physical Risks of Cash:

- Theft: A cash drawer is a prime target for both external and internal theft.

- Counterfeit Bills: Accepting a fake bill means you've given away a service for free.

- Miscounts: Simple errors when giving change or counting the till lead to frustrating shortages.

Digital Security Measures:

- PCI Compliance: Reputable payment processors are PCI compliant, adhering to strict security standards to protect card data.

- Encryption & Tokenization: From the moment a card is used, the data is scrambled and converted into a secure token, making it useless to thieves.

- Reduced Physical Risk: With less cash on-site, your shop becomes a less attractive target for break-ins.

Ultimately, a well-configured digital system offloads the burden of security to specialized companies. To ensure seamless and secure transactions, a reliable internet connection is non-negotiable. Investing in a quality internet speed for business is a critical part of your digital infrastructure.

Choosing The Right POS System For Your Barbershop

Making the leap to card payments means picking the right technology. A Point of Sale (POS) system is more than a card reader; it's the new operational hub of your barbershop. The right one makes payments effortless, automates bookkeeping, and integrates with the tools you already use.

The barbershop POS market is growing rapidly for a reason. Valued at USD 450 million in 2025, it’s projected to double to nearly USD 900 million by 2033. This 8% annual growth is fueled by clients who expect modern payment options and shop owners who need a unified system to manage everything from bookings to inventory.

Key Factors For Your Decision

When comparing POS options, look beyond the monthly fee to the total value it provides your shop.

- Transaction Fees: Understand the full fee structure. Are rates different for tapped, swiped, or manually entered cards? Are there extra charges for premium cards like American Express? The details are crucial.

- Hardware Costs: A mobile reader can cost as little as $49, while a full station with a tablet, stand, and cash drawer can exceed $1,000. Choose based on your counter space and transaction volume.

- Ease of Use: Your team must be able to adopt it quickly. A clunky interface slows down checkouts and frustrates both barbers and clients.

- Essential Integrations: A modern POS should connect with your other business tools. Seamless integration with your booking calendar is non-negotiable. A system that helps you smoothly book an appointment with your barber is essential for a well-run shop.

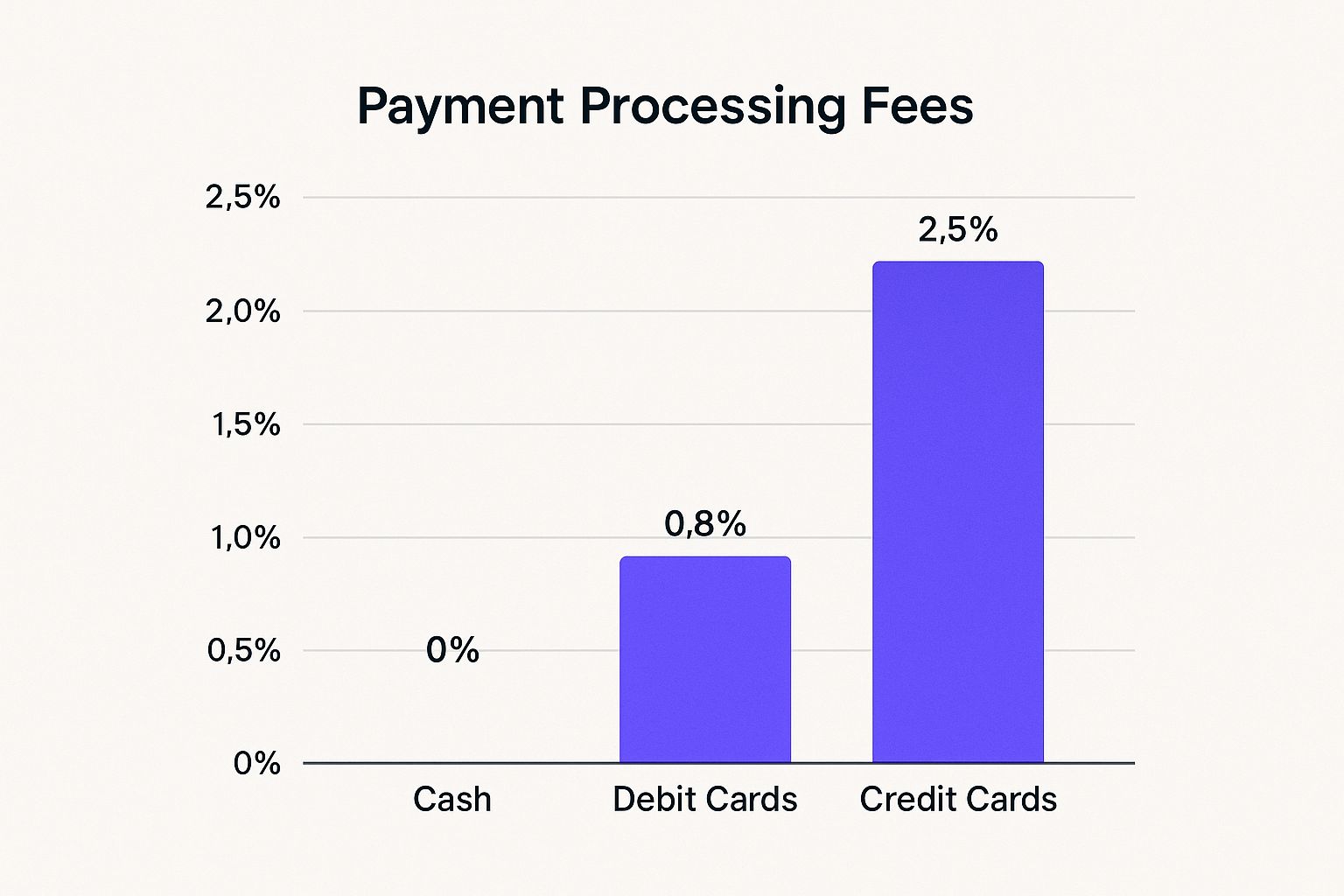

The image below illustrates the fundamental cost difference between payment types.

It’s clear: cash is free to accept, but every card payment has a processing cost that directly impacts your profit margin.

Actionable Takeaway: Your POS system should save you more in time and efficiency than it costs in fees. If a $50/month POS subscription saves you 10 hours of admin work (valued at $50/hour), your ROI is $450 per month. That's a smart investment.

Comparing Top Barbershop POS Systems

To help you start, here's a breakdown of three popular POS systems, each suited for a different type of barbershop.

Barbershop POS System Comparison

| POS System | Transaction Fees | Hardware Cost | Best For |

|---|---|---|---|

| Square | 2.6% + 10¢ (in-person) | $0 for first reader; $49+ for others. | Solo barbers and small shops needing a simple, integrated booking and payment solution. |

| Fresha | 2.19% + 20¢ (plus subscription) | $29 for a card terminal. | Shops wanting an all-in-one platform for booking, marketing, and payments with lower transaction fees. |

| Clover | Varies by plan; custom rates. | $499+ for a full station. | Larger, multi-chair shops needing advanced tools for inventory, payroll, and staff management. |

The right POS depends on your shop's size, budget, and operational needs. The goal is to choose a system that simplifies your business, not complicates it.

Your Questions About Going Cashless Answered

Switching from cash brings up practical questions about tradition, customer habits, and daily operations. Let's tackle the most common concerns.

How Do I Handle Barber Tips in a Cashless System?

This is the number one concern for most barbers. Modern POS systems are designed to handle tipping seamlessly. During checkout, the terminal automatically prompts clients to leave a tip, offering preset options like 15%, 20%, or 25%, as well as a custom amount.

Industry data shows that this digital prompt often leads to higher and more consistent tips, as it removes any awkwardness. All tips are tracked automatically and assigned to the correct barber in the system's reports, making payroll accurate and eliminating the need to split a cash jar at the end of the day.

Will I Lose Customers if I Stop Accepting Cash?

It's a valid worry, but the risk is smaller than you might think. While a few long-time clients might prefer cash, you are far more likely to gain new customers who expect to pay with a card. A 2023 survey revealed that 41% of Americans rarely or never carry cash, a figure that is even higher among younger demographics.

Actionable Takeaway: The best strategy is to start with a hybrid model. Accept both cash and cards. This keeps your regulars happy while opening your doors to a much larger, card-carrying audience.

Be transparent. Post clear signs at your entrance and stations. After a few months, your POS data will show you what percentage of your business is cashless. If 90-95% of payments are on cards, you'll have the data to confidently decide if going fully cash-free is right for you.

Can I Pass Processing Fees on to My Customers?

Yes, but it must be done correctly. Adding a credit card surcharge is legal in most states, but there are strict rules. You must post clear signage, and the fee cannot exceed your actual processing cost (typically capped at 3-4%).

A more customer-friendly approach is to incorporate the cost into your service prices. A modest $1-$2 price increase is often better received than a surprise fee at checkout. Alternatively, you can frame it as a "cash discount" program, offering a small discount for those who still pay with cash. This positions the change positively while ensuring your costs are covered.

Should I Go Completely Cash-Free or Accept Both?

For nearly every barbershop, a hybrid model is the ideal starting point. It's the safest and most flexible way to modernize your payment system without disrupting your business. This approach allows you to reap the major benefits of accepting cards—like automated bookkeeping and attracting new clients—while giving your community time to adapt.

This strategy also provides you with invaluable data. After a few months, you'll know exactly how your clients prefer to pay. This information empowers you to make a strategic, data-driven decision about whether going 100% cash-free is the right move for your shop's unique brand and clientele.

Ready to create a professional online presence that works as hard as you do? Cuts.site builds you a stunning bio site that syncs directly with your Square booking system, putting your services, barbers, and booking link all in one place. No setup required. Get your site today at Cuts.site.